top of page

QT & Powell's Liquidity Trap

The Federal Open Market Committee has arguably lost control of monetary policy and has placed America's banks in grave risk.

-

Feb 27, 20236 min read

Is Stripe Worth $55 Billion? Really?

CEO Patrick Collison is guiding investors and the media to a $200 million profit in 2023. Selective disclosure??

-

Feb 21, 20236 min read

Ginnie Mae - Credit Suisse = ? A Biden MSR Tax? Does BKI + ICE = < 2?

Our view is that the BKI purchase is a horrible deal for ICE shareholders, a value killer of epic proportions

-

Feb 13, 20238 min read

Goldman Sachs + Bank of New York Mellon = ?

The risk-adjusted return on capital for BK is negative and probably lower than Goldman, the highest risk large US bank

-

Feb 6, 20237 min read

Why the FT is Wrong About Ally Financial

Ally is still more finance company than bank and really has no core deposit base worthy of the name.

-

Jan 30, 20237 min read

Update: Bank of America

We hear in the channel that regulators are making their views of future loss probabilities very clear in guidance to the top banks

-

Jan 23, 20236 min read

Goldman Drops Restatement; Jamie Dimon Drops the Ball on "Frank"

The Fed’s de facto embrace of inflation encourages misallocation of economic resources on a grand scale....

-

Jan 16, 20237 min read

Update: JPMorganChase & Wells Fargo

But nothing lasts forever in mortgage land or in financials. Stay tuned and pay attention to LT rates and spreads...

-

Jan 13, 20236 min read

Update: Truist, Charles Schwab, U.S. Bancorp & PNC Financial

The largest banks continue to serve as a haven for refugees from crypto fraud schemes and the fintech swoon, but are not cheap

-

Jan 4, 20237 min read

GNMA, FNMA Seize Assets from Reverse Mortgage Funding Estate

The US government now owns the largest reverse lender in the country.

-

Dec 22, 20226 min read

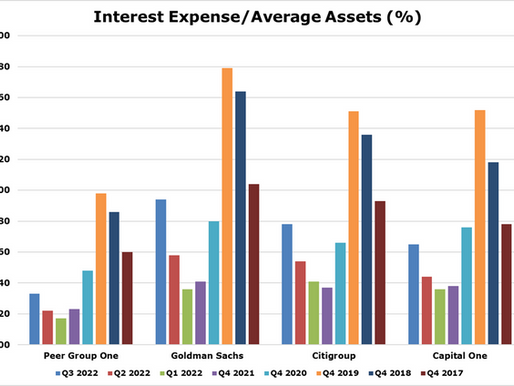

Outliers: CapitalOne, Goldman Sachs & Citigroup

Like most nonbanks (and Goldman Sachs is predominantly a nonbank), volumes are falling and funding costs are rising.

-

Dec 20, 20225 min read

The Year That Was: 2022

Many in the Buy Side chorus are looking forward to lower interest rates, but we are concerned that next year could really be about solvency

-

Dec 16, 20226 min read

Bank M2M Losses Surge in Q3 to $347 Billion

Rapidly rising interest rates in Q3 2022 pushed down the tangible capital for the US banking industry to negative $1.9 trillion

-

Dec 6, 20221 min read

Is JPMorgan Chase Insolvent?

The US banking industry has been rendered insolvent by the Federal Open Market Committee

-

Nov 28, 20226 min read

Crypto Crash Signal End of Fintech?

Despite all the hyperbole, the great crypto fraud was a small game, like the party poker that many crypto enthusiasts share in common

-

Nov 25, 20229 min read

Loan Delinquency, EBOs & Ginnie Mae MSRs

It seems obvious that the reported book value metrics coming from many commercial banks, REITs and mortgage banks are a tad inflated...

-

Nov 15, 20226 min read

Update: Crypto Fraud Crumbles as Bank Stocks Surge

Crypto has gone from a sort-of juiced up equity strategy to a distressed credit story in just hours.

-

Nov 10, 20225 min read

Brief: The Return of Home Equity Loans

Every residential mortgage loan made in 2020-2021 is likely to be underwater by the end of 2023

-

Nov 7, 20227 min read

TIAA Sells Everbank; Mortgage Earnings Wrap

The big news this week starts with the poor showing by Rocket Companies (RKT), reporting a loss for Q3 2022 and a big decline in volumes.

-

Nov 4, 20225 min read

Update: Credit Suisse (CS) & PennyMac Financial (PFSI)

Like COOP, volumes are down dramatically from 2021 but MSR values and cash flows from servicing are rising

-

Oct 28, 20227 min read

bottom of page

.png)