top of page

Pulte Pulls the Plug on GSE Release? Are LDI and UWMC Underwater?

We expect the shares of the GSEs to lose ground this week given last week’s bizarre announcement by Federal Housing Finance Agency Director Bill Pulte that the GSEs will not be released from conservatorship after all. After pumping the two stocks for months with the prospect of release from conservatorship, Pulte said Friday that the GSEs would stay under federal control for now, reinforcing their conservatorship status while exploring a limited public offering option.

-

Nov 10, 20259 min read

The Single Fed Mandate & Bank Stocks

The Fed's actions in 2008 and again in March 2020 were largely driven by the sole mandate of the central bank -- to keep the Treasury market opening and functioning.

-

May 14, 20259 min read

Fed Duration Trap Threatens Banks, SOMA

It’s time for the Fed to get smart on duration risk before circumstances create another money market crisis.

-

Nov 1, 20248 min read

Profile: Comerica Inc.

If the FOMC raises the target rate for fed funds further, then banks like CMA are likely to come under renewed selling pressure.

-

Jun 28, 20237 min read

Powell Ought to Pivot to Bond Sales

If the FOMC raises fed funds further, bank failures and perhaps even a market access crisis for the Treasury are next.

-

Jun 19, 20238 min read

QT, Interest Rates & Bank Solvency

At the Fed, because “confidence” is considered a factor in “policy,” it is OK to fib and obfuscate about the true cost of monetary policy.

-

Mar 30, 20236 min read

FOMC Doubles Down on Market Risk

Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell are another bank failure or two away from returning to the private sector.

-

Mar 23, 20236 min read

QT & Powell's Liquidity Trap

The Federal Open Market Committee has arguably lost control of monetary policy and has placed America's banks in grave risk.

-

Feb 27, 20236 min read

Inflation, Politics & Fed Chairmen

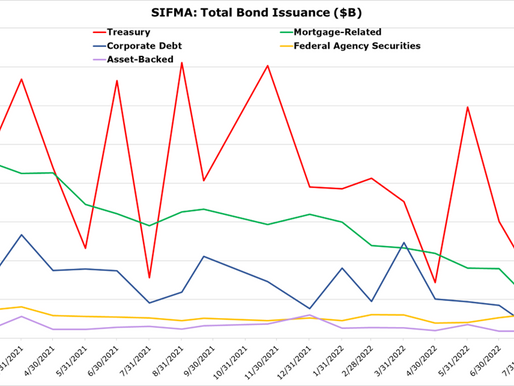

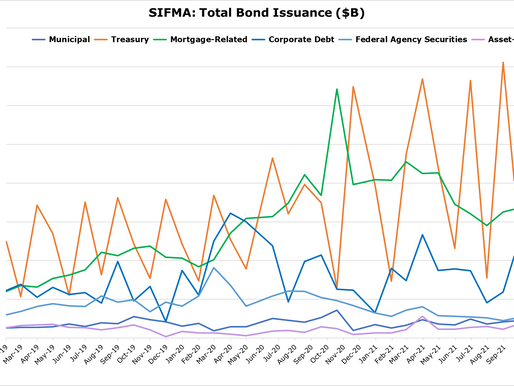

As the scale of Fed open market operations grew since 2008, volatility has increased, rendering the adjustment from QE to QT problematic

-

Sep 18, 20229 min read

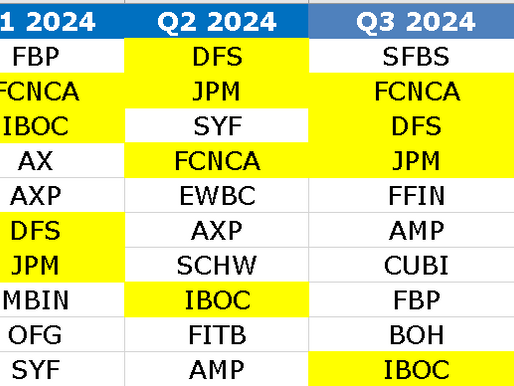

Update: The Bull Case for US Financials

Investors who were buying large caps at 2x book value a year ago are now running away from bank stocks just as fundamentals improve...

-

Sep 8, 20225 min read

Interest Rates, FinTechs & MSRs

Interest rates are starting to be very positive, and bank deposit rates are barely moving, so pretense of fintech as bank killer is over

-

Aug 21, 20227 min read

Short Collateral & Long Tantrums

Demand for risk-free collateral and liquidity is largely a function of how JPMorgan (JPM) CEO Jamie Dimon feels about risk on any given day

-

Jul 31, 20228 min read

The Fed and Housing

Issuing CMOs via the GSEs could help the FOMC out of its trading mess, but represents a monumental irony.

-

Jun 20, 20228 min read

Equity Market Valuations & Quantitative Tightening

The reduction in the Fed's balance sheet is the largest ever margin call on equity exposures of all descriptions.

-

May 23, 20227 min read

Chairman Powell's Duration Problem

Chairman Powell’s demeanor during the press conference when he spoke with Mike McKee suggests a man who knows he has a problem.

-

May 8, 20228 min read

Interest Rates, Stocks & MSRs

We think the chart below from FRED is worth any amount of words on the impact of QE on equity market valuations.

-

Jan 6, 20225 min read

As the Fed Ends QE, Stocks and Crypto Will Retreat

And in the meantime, we view the end of QE as a net negative for global stocks as well as crypto. Everything is correlated in a crowd.

-

Nov 15, 20214 min read

Three Questions for Chairman Powell

Look for the FOMC to act early and go big in terms of forward repurchase agreements at the first sign of liquidity stress.

-

Oct 25, 20216 min read

Debt Ceilings & Interest Rate Floors

When Treasury market yields trade and stay negative, look for the Federal Reserve Board to come to the rescue of MM funds and banks.

-

Sep 13, 20217 min read

Update: Q1 2021 Bank Earnings

US banks are running at income levels that are less than half of a year ago...

-

Mar 25, 20217 min read

bottom of page

.png)