top of page

Q4 Bank Earnings Setup: BAC, C, JPM, TFC, PNC, USB, WFC

Of note, JPM's CFO Barnum said in response to a question that “I haven't heard anything to suggest that the private [credit] deals are performing differently from the public deals. It probably is true at the margin that some of the new direct lending initiatives involve underwriting at slightly higher expected losses, and that's significant because, as we've been discussing here, the wholesale charge-off rate has been very, very low for a long time."

-

Dec 18, 20257 min read

JPMorgan, Growing Large Bank Risk & Private Credit

The surprise pre-release of Q4 results led to a significant drop in JPMorgan's stock price and took down the entire sector along with it. But is this the only negative surprise likely to come from JPM? We think not. CNBC’s Jim Cramer said on X yesterday that investors should buy JPM on the dip, but we disagree. In fact, the markets seem to know something about JPM. Maybe this explains why Citigroup (C) has outperformed the House of Morgan all year.

-

Dec 11, 20258 min read

Bank of America: Warren Buffett Sells, Brian Moynihan Waffles

“Moynihan is trying to demonstrate that the business can grow and hedge funds different investors in stock want price appreciation not just dividend. The decision to host the investor day was made long ago - JPM does it every year. Jamie Dimon has taken away the excuses of big banks that they can’t grow.”

-

Nov 6, 20256 min read

France Downgraded Below JPMorgan

In this edition of The Institutional Risk Analyst, we ponder the world of credit and investing as sovereign nations see their debt ratings sinking below that of global corporations. Meanwhile, the price of gold is reaching new highs. Then we set up the Q3 earnings of the top-seven US depositories for subscribers to our Premium Service as we surge into quarter end with equity markets at all-time highs and global central banks turning the money spigots wide open.

-

Sep 15, 20257 min read

PNC + FirstBank = Shareholder Value?

PNC went down less in April, but then lagged the leaders in our bank test group, not exactly a rousing vote of confidence in the $550 billion bank. The acquisition of FBHC may not help. The traditional rule of thumb in banking is that paying anything more than 1.25x book for a bank is usually not recovered. We do not have a position in PNC.

-

Sep 11, 20255 min read

Market Risk Threatens US Banks

The largest bank loan portfolio increases reported by the FDIC were in loans to non-depository financial institutions and broker-dealer loans to purchase or carry securities, including margin loans. This situation is inherently unstable.

-

Aug 31, 20253 min read

BAC Almost Tipped Over? | Trading Points: Citi, Goldman, PennyMac and Mr. Cooper

Citi has grown corporate loans 10% to $330 million at the end of Q2 2025. In fact, Citi increased its full-year net interest income guidance and raised its revenue forecast to the high end of its previous range. Citi saw assets and NII grow in 2025, but efficiency remained in the low 60s, a tangible indication that Fraser is making progress.

-

Jul 26, 20258 min read

Q2 Earnings Setup: JPM, BAC, C, PNC, TFC, USB, WFC

We noted in the most recent IRA Bank Book that the Q1 2025 banking industry data from the FDIC was showing improvement in certain commercial line items, particularly non-owner occupied real estate. But is this another head fake by desperate banks trying to conceal rancid commercial real estate exposures?

-

Jun 22, 20257 min read

Q: Which Top Seven Bank is Most Vulnerable in a Recession?

If we consider the larger picture, we already have years of pent-up credit expenses awaiting realization, but add to the sauce Donald Trump.

-

Mar 23, 202514 min read

Update: Has Jane Fraser Redeemed Citigroup? Nope.

Citi seems to be tracking the group now, whereas pre-COVID the stock significantly underperformed in terms of market beta. But performance?

-

Dec 18, 20247 min read

New & Old Names in Nonbank Finance

In dollar terms, the moves in 2023 were tiny vs the post March rally in 2020.

-

Aug 21, 20247 min read

The Top Seven Banks: JPM, BAC, C, WFC, USB, PNC & TFC

Banks lose money every single day by holding onto a below market security from the 2019-2021 period.

-

Aug 18, 20249 min read

Q2 2024 Earnings Setup: JPM, BAC, WFC, C, USB, PNC, TFC

Citigroup leads the pack with a net loss rate of 133 basis points (bp) that is almost five times the average for Peer Group 1 at 27 bp.

-

Jun 23, 20249 min read

Vanguard & Black Rock Control JP Morgan? | PNC & United Wholesale Mortgage

BK and Vanguard are above the 4.9% legal limit on ownership of voting shares of a bank. This fact gives the FDIC et al the power...

-

Apr 4, 20247 min read

What Does PNC Financial Say About Commercial Real Estate?

What does PNC tell us now about commercial loan exposures in 2024?

-

Dec 12, 20236 min read

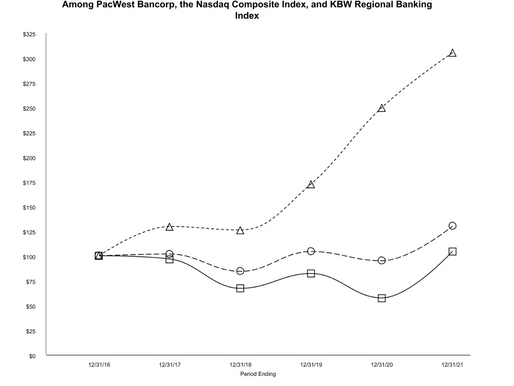

Does PacWest + Banc of California + Warburg Pincus = Value?

The Q2 2023 disclosure for PACW suggests an institution that is bleeding cash and operating in extremis...

-

Sep 18, 20237 min read

Profile: Comerica Inc.

If the FOMC raises the target rate for fed funds further, then banks like CMA are likely to come under renewed selling pressure.

-

Jun 28, 20237 min read

Update: Charles Schwab (SCHW); Sagent Presentation

Most major banks grew larger during quantitative easing. Now many of these banks will shrink in terms of assets and also earnings in Q1 2023

-

Apr 3, 20236 min read

Goldman Drops Restatement; Jamie Dimon Drops the Ball on "Frank"

The Fed’s de facto embrace of inflation encourages misallocation of economic resources on a grand scale....

-

Jan 16, 20237 min read

Update: Truist, Charles Schwab, U.S. Bancorp & PNC Financial

The largest banks continue to serve as a haven for refugees from crypto fraud schemes and the fintech swoon, but are not cheap

-

Jan 4, 20237 min read

bottom of page

.png)