top of page

LendingClub Corporation: Impressive Growth and Risk Leverage

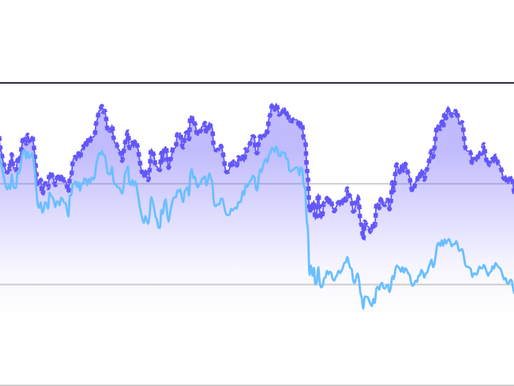

LC is clearly succeeding where the larger banks are not in terms of both loan originations and loan sales, which are shown in the chart below. If LC can continue to create assets and also sell loans to investors, that is an indication of a healthy business. But the big question for us is how much of the consumer lending opportunity can LC capture and retain? The table below shows the gross loan yield, net loss rate and net income vs average assets for LC and its bank competi

-

Jan 49 min read

Profile: The Bank of New York

As of yesterday's close, BK was right behind SoFi Technology (SOFI) leading the bank surveillance group higher. BK closed yesterday at 14x forward earnings and 1.6x book value, roughly the same PE multiple as JPM but at a lower book value multiple.

-

Jun 3, 20255 min read

Update: Charles Schwab | SCHW

The SVB duration management from 2020 onward was recklessly negligent by any reasonable standard

-

Jan 22, 20255 min read

The IRA Bank Book Q4 2024

WGA notes that bank stock prices have soared in the second half of 2024, with the WGA Bank Top 10 Index up 40% year-to-date in 2024.

-

Dec 16, 20243 min read

Banks: Passive Strategies Lag Active Management

In the third quarter of publishing the Indices, so far picking quality banks seems to matter more than following the passive ETF herd

-

Sep 4, 20245 min read

Yellen's FSOC: Housing Policy Dreams vs Mortgage Market Reality

Yellen's proposal for a backstop is merely a canard to help Treasury avoid another fiasco next time a Ginnie Mae issuer fails

-

Jul 30, 20246 min read

Update: BMO + Bank of the West = ?

BMO arguably has the weakest reserve position among the large Canadian banks....

-

Jun 17, 20246 min read

WGA Releases Top 50 Bank Index | What's in Your ETF?

Not all banks or companies are the same and not all follow the herd.

-

Feb 25, 20245 min read

bottom of page

.png)