top of page

JPMorgan, Growing Large Bank Risk & Private Credit

The surprise pre-release of Q4 results led to a significant drop in JPMorgan's stock price and took down the entire sector along with it. But is this the only negative surprise likely to come from JPM? We think not. CNBC’s Jim Cramer said on X yesterday that investors should buy JPM on the dip, but we disagree. In fact, the markets seem to know something about JPM. Maybe this explains why Citigroup (C) has outperformed the House of Morgan all year.

-

Dec 11, 20258 min read

The Wrap: Apollo's PE Myths? Bitcoin = Fraud, PIK = Default

As we have said consistently, it is better to own the shares of stronger crypto enablers like HOOD and SOFI than the tokens themselves. It is the enablers who profit at the expense of the remaining true greater. We were watching a fascinating conversation with independent technology analyst and advisor Benedict Evans earlier this week and he made the point that serious technologists have largely abandoned crypto as an area of study.

-

Dec 4, 20256 min read

AI Implodes! Private Credit Collapses! And a Trillion Dollar TGA Looms

Most public companies are so invested in the false gospel of AI that they dare not even hint at the truth, namely that the vast majority of AI projects will never be profitable or even relevant. As LeCun notes, consumers will benefit from more robust search tools, but the AI that emerges in the next decade will be too feeble and too fallible to be deployed by business. Recall the costly fiasco of the early AI charade called "Watson" from IBM.

-

Nov 18, 20257 min read

Circle Internet Soars; BNPL FinTechs Rally as Recession Fades

The proliferation of low- or no-cost coin systems is ultimately negative for established players in nonbank finance and payments, including the major card issuers, as we discuss below. Still worried about interchange fees?

-

Jun 8, 20257 min read

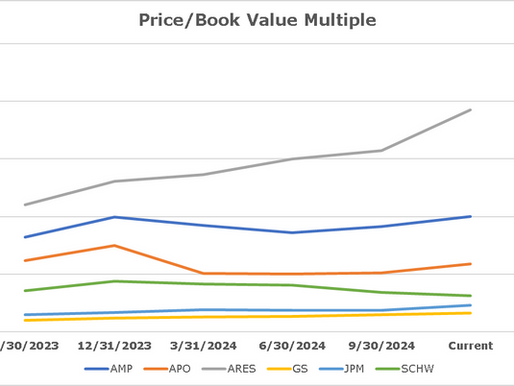

Is Ameriprise Overvalued? Is PennyMac Cheap vs the REITs?

We think it is notable that AMP has underperformed the other members of the group other than SCHW over the past year.

-

Feb 3, 20257 min read

Stocks Swoon, Retail Credit Rises: PYPL, SQ & ARES

The rotation away from institutional investors to retail funding source for the $1.7 trillion direct lending market is an ominous sign

-

Aug 2, 20248 min read

Inside the Private Credit Trade

Direct lenders are the pawnbrokers of the 21st Century for subprime commercial borrowers, usually firms financed via leveraged buyouts.

-

Jun 4, 20246 min read

bottom of page

.png)