top of page

Should the FOMC Pause Rate Hikes After July?

The real message to the FOMC is this: hike another 75bp in July and then let the Fed funds target sit for a few meetings...

-

Jul 21, 20225 min read

Dollar Remains World Reserve Currency

Once again the US is coming out of a global crisis as the cleanest dirty shirt in the laundry.

-

Jul 18, 20223 min read

Top Five US Banks by Market Performance

In times of market volatility and suddenly ended delusions of easy money, the prudent path is to fly to quality.

-

Jul 7, 20225 min read

Hard Landings & Systemic Crypto

Putting dollar leverage under crypto tokens – that is to say, under nothing – makes for infinite dollar risk.

-

Jul 4, 20226 min read

Bank Liquidity & Quantitative Tightening (QT)

A "normal" level for US bank deposits would be closer to $15 trillion than $19.9 trillion today.

-

Jun 27, 20223 min read

The Fed and Housing

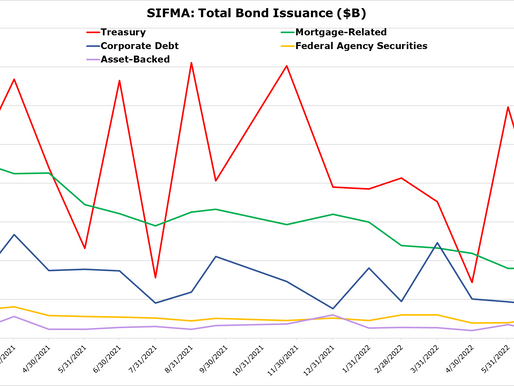

Issuing CMOs via the GSEs could help the FOMC out of its trading mess, but represents a monumental irony.

-

Jun 20, 20228 min read

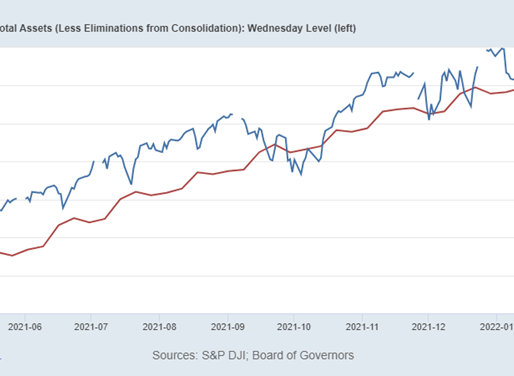

QE = Supranormal Credit Risk

Given the demand for safe assets, the true risk free rate today is probably less than zero. Ponder that Chairman Powell

-

Jun 12, 20227 min read

FOMC vs TGA; PennyMac Financial & United Wholesale Mortgage

Net, net, the dynamics in the market are actually forcing interest rates down

-

May 25, 20229 min read

Feldkamp: Paul Volcker, Volatility, Inflation & Honesty

Benevolence, as Chris and I noted in our book "Financial Stability," always gets you more bang for the buck than being miserable.

-

May 13, 20225 min read

Interest Rates, Credit and MSRs

Even as Powell signals willingness to take interest rate targets higher, he has put off a decision on the Fed's balance sheet until June.

-

May 4, 20225 min read

Where is Value in Fintech?

Take the financials and add some unicorn dust in terms of innovation to the mix and perhaps a double-digit PE ratio for PYPL makes sense.

-

May 2, 20225 min read

Flagstar Bancorp & Annaly Capital: All About Visibility

No amount of computer power can really, really enable you to predict when Fred and Wilma are going to sell or refinance their home.

-

Apr 28, 20225 min read

Deflation, Not Inflation, is the Threat

Xi Jinping in China and Putin in Russia have turned their backs on the global economy to retain power

-

Apr 26, 20226 min read

Weak Bank Earnings & Surging Interest Rates = Lower Valuations

Will Fed Chairman Jay Powell fold in terms of further rate hikes if the S&P 500 falls 1,000 points in a day?

-

Apr 11, 20225 min read

The Next Trade: Banks, Nonbanks and Mortgage Servicing Rights

Many of the startups, investment flows and SPAC transactions that proliferated in 2020-2021 are likely to be casualties in the next several

-

Apr 6, 20224 min read

Why the FOMC Cannot Sell its Mortgage Bonds

With MBS prices falling, the FOMC may have to accept the natural runoff rate for the MBS in the SOMA for many years to come

-

Mar 31, 20225 min read

Top Five US Banks: USB, JPM, WFC, C & BAC

Valuations for the top five US banks are up slightly as Q1 2022 comes to an end

-

Mar 28, 20226 min read

Will SOFR Be the Death of Jay Powell?

If the Fed causes another liquidity crisis as it ends QE and shrinks the balance sheet, then Chairman Powell should immediately resign.

-

Mar 21, 20226 min read

QE, Risk Premia and Option Adjusted Spreads

There a brisk debate ongoing in the fixed income markets over how much the Federal Open Market Committee will raise interest rates and when

-

Mar 15, 20225 min read

A Tale of Two Mortgage SPACs: UWMC and FOA

Why did FOA write down $1.4 billion in intangible equity, yet UWM took no similar write down?

-

Mar 9, 20224 min read

bottom of page

.png)