top of page

FOMC Doubles Down on Market Risk

Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell are another bank failure or two away from returning to the private sector.

-

Mar 23, 20236 min read

Mark-to-Market on Bank America; Update on Credit Suisse & Guild Holdings

We recently added Western Alliance (WAL) and GHLD to our portfolio

-

Mar 17, 20238 min read

QE & the Yellen Banking Crisis

By any reasonable standard, Janet Yellen should have already resigned, but not in the strange world of Washington.

-

Mar 14, 20238 min read

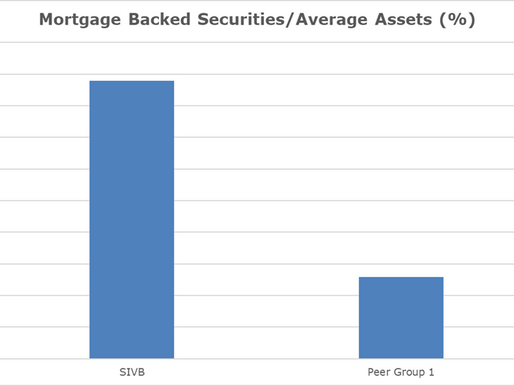

Who Killed Silicon Valley Bank?; The IRA Bank Book Q1 2023

Last week not a single member of the Big Media managed to ask Fed Chairman Jerome Powell about the state of the US banking system

-

Mar 11, 20236 min read

Atlas Stumbles, Silvergate Wallows; 360 Mortgage v. Fortress (and RITM)

Are nonbank mortgage firms a risk to Ginnie Mae? Or is it really the other way around?

-

Mar 6, 20238 min read

QT & Powell's Liquidity Trap

The Federal Open Market Committee has arguably lost control of monetary policy and has placed America's banks in grave risk.

-

Feb 27, 20236 min read

Is Stripe Worth $55 Billion? Really?

CEO Patrick Collison is guiding investors and the media to a $200 million profit in 2023. Selective disclosure??

-

Feb 21, 20236 min read

Will We See Double-Digit Residential Mortgage Rates -- Again?

As the FOMC moves short-term rates towards 6%, we expect to take another run at double-digit rates for prime residential mortgage loans.

-

Feb 16, 20235 min read

Two Inflation Narratives; Credit Suisse & Ginnie Mae MSRs

The big take away from Q4 2022 earnings is that credit expenses are headed higher and at a brisk pace

-

Feb 3, 20239 min read

Silvergate, Reverse RPs and the “Theology of Prosperity”

Crypto, of course, is not an asset as much as a bad idea that was given life by Quantitative Easing

-

Jan 25, 20238 min read

Update: Bank of America

We hear in the channel that regulators are making their views of future loss probabilities very clear in guidance to the top banks

-

Jan 23, 20236 min read

Interview: Mike Patterson, Freedom Mortgage

In this issue of The Institutional Risk Analyst, we speak to Mike Patterson, COO of Freedom Mortgage.

-

Jan 19, 20239 min read

Goldman Drops Restatement; Jamie Dimon Drops the Ball on "Frank"

The Fed’s de facto embrace of inflation encourages misallocation of economic resources on a grand scale....

-

Jan 16, 20237 min read

Update: Truist, Charles Schwab, U.S. Bancorp & PNC Financial

The largest banks continue to serve as a haven for refugees from crypto fraud schemes and the fintech swoon, but are not cheap

-

Jan 4, 20237 min read

GNMA, FNMA Seize Assets from Reverse Mortgage Funding Estate

The US government now owns the largest reverse lender in the country.

-

Dec 22, 20226 min read

Outliers: CapitalOne, Goldman Sachs & Citigroup

Like most nonbanks (and Goldman Sachs is predominantly a nonbank), volumes are falling and funding costs are rising.

-

Dec 20, 20225 min read

Blockchain, Crypto & Falling Liquidity

Whether we are talking about corporate credit exposures or housing, the short trade may be the place to be over the next year.

-

Dec 9, 20225 min read

Record Losses for Mortgage Banks Presage Tough Year Ahead

Is 2023 the year of the Return of the Distressed Loan Trade?

-

Nov 19, 20221 min read

Extension Risk Threatens US Banks

There are literally dozens of banks in the US made insolvent by the policy moves of the FOMC over the past year.

-

Nov 17, 20227 min read

Interview: David Stevens on GNMA Capital Rule & ICE + BKI

The entire mortgage industry will have a single point of failure with the ICE/BKI combination

-

Sep 11, 20228 min read

bottom of page

.png)