top of page

Interest Rates, MSRs, Mortgage Putbacks & FICO Scores

Persistent talk about a 5.5% 30-year mortgage rate later this year is badly wrong as TBAs flip from 5.5% to 6% coupons for delivery in June

-

May 25, 20238 min read

PacWest Bancorp & Fed Hawks

To survive long-term, both WAL and PACW need to get that beta back down below 2 and closer to 1, but the hawks on the FOMC may not cooperate

-

May 23, 20237 min read

Banks, Commercial Real Estate & Credit

The Fed's 5.5% increase in short-term interest rates has thrown the pricing for trillions of dollars in real estate into disarray.

-

May 17, 20235 min read

Fed Asymmetry Threatens Credit Crisis

The price volatility injected into markets by the Fed is a primary reason why the FDIC cannot easily find buyers for smaller banks.

-

May 15, 20236 min read

Measuring Powell's Bank Rate Shock

Q: What happens to net-interest margin for banks when the rate of change in funding costs doubles or more in a single quarter?

-

May 7, 20236 min read

Banks, Interest Rates & Fed Chairs

Imagine how President Joe Biden will react if Chair Powell needs to announce formal limits on access to US bank deposits.

-

May 4, 20234 min read

The False Narrative on First Republic Bank

Until Chairman Powell comes clean with the Congress and the American people, more banks will inevitably fail.

-

May 1, 20236 min read

Commercial Real Estate & Bank OZK

Banks that do not aggressively reprice liabilities and assets as OZK did in Q1 2023 may be left behind.

-

Apr 24, 20236 min read

The Bank Deposit Run Is Not Over

The funding crisis affecting US banks is not over and very definitely not limited to smaller banks.

-

Apr 19, 20237 min read

Q1 2023 Bank Earnings: Lower for Longer | JPM USB C WFC BAC

Given that the US Treasury is paying 4% for 90-day T-bills, you can see how far banks have to go to become competitive on rates

-

Apr 12, 20238 min read

Powell's Duration Trap, Banks and the US Treasury

The Fed by definition cannot make a profit and is always an expense to the Treasury, thus operating losses are a expense to the taxpayer

-

Apr 9, 202312 min read

Update: Charles Schwab (SCHW); Sagent Presentation

Most major banks grew larger during quantitative easing. Now many of these banks will shrink in terms of assets and also earnings in Q1 2023

-

Apr 3, 20236 min read

QT, Interest Rates & Bank Solvency

At the Fed, because “confidence” is considered a factor in “policy,” it is OK to fib and obfuscate about the true cost of monetary policy.

-

Mar 30, 20236 min read

Update: New York Community Bank

We liked the NYCB + Flagstar story prior to the transaction with the FDIC for the assets and deposits of Signature Bank.

-

Mar 26, 202310 min read

FOMC Doubles Down on Market Risk

Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell are another bank failure or two away from returning to the private sector.

-

Mar 23, 20236 min read

Winners & Losers in the New Gilded Age

Mark Twain called Washington ''the grand old benevolent National Asylum for the Helpless'' in his classic "The Gilded Age."

-

Mar 21, 20235 min read

Mark-to-Market on Bank America; Update on Credit Suisse & Guild Holdings

We recently added Western Alliance (WAL) and GHLD to our portfolio

-

Mar 17, 20238 min read

QE & the Yellen Banking Crisis

By any reasonable standard, Janet Yellen should have already resigned, but not in the strange world of Washington.

-

Mar 14, 20238 min read

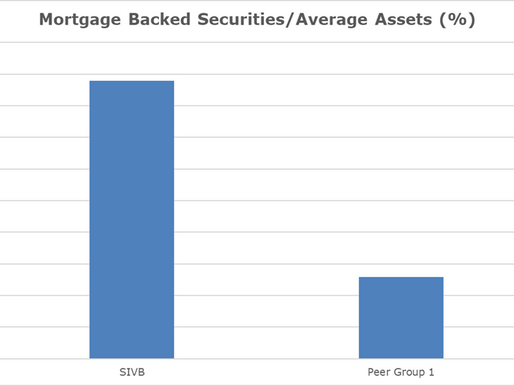

Who Killed Silicon Valley Bank?; The IRA Bank Book Q1 2023

Last week not a single member of the Big Media managed to ask Fed Chairman Jerome Powell about the state of the US banking system

-

Mar 11, 20236 min read

RKT Sinks, UWMC Wobbles, RITM Treads Water & Goldman Doubles Down

GS is a securities dealer first and foremost and has no comparative advantage as a bank.

-

Mar 2, 20236 min read

bottom of page

.png)