The Bank Book Q1 2021: Loss Reserve Releases to Boost Earnings

- Mar 12, 2021

- 8 min read

Review & Analysis

March 12, 2021 | In this issue of The IRA Bank Book, we take a look at the health of the US banking sector as we approach Q1 2021 earnings. The good news is that banks are liquid and well-capitalized, but the bad news is that total credit provided to the US economy is falling. The chart below illustrates the failure of current policy by the Federal Open Market Committee, with deposits soaring and lending declining, led by lower commercial and industrial (C&I) loans.

Source: FDIC

If we take a closer look at total deposits, the growth in total deposits contrasts with the marked decline in time deposits placed with US banks. As more fiscal stimulus moves into the US economy, Treasury cash held by the Federal Reserve will decline and bank deposits will grow, but there is little indication that further expansion of bank deposits will lead to increased lending and economic growth.

Source: FDIC/WGA LLC

Bank deposit growth rates slowed overall in Q4 as Treasury cash balances grew but federal outlays were constrained prior to the November election. That said, bank deposits still grew at almost a 5% annual rate in Q4 2020 even as loans fell slightly. The key point is that there appears to be no added leverage in the US economy due to the added bank liquidity from QE.

If we broaden the analysis and add the assets sold and securitized by US banks, the data again reveals a decrease in credit creation and business volumes moving through banks. Note that sales of C&I loans have ceased entirely and most other loan categories are down significantly. Bank sales of 1-4 family residential loans are now below $400 billion per quarter and are likely to continue to fall even as the industry has another strong year in terms of mortgage originations.

Source: FDIC

Even as bank lending and asset sales continue to fall, the cost of funds to the industry is also declining rapidly. This has the effect of boosting short-term earnings, but does little to boost assets returns or bank income over the medium term.

For example, in the secondary market for residential mortgages, secured bank warehouse facilities are earning just 1.75% over LIBOR and larger nonbank borrowers are demanding even lower rates. Of note, even as yields on Treasury securities and mortgage-backed securities have risen in the past month, the yield on new loan pools trading in the to-be-announced (TBA) market moved very little.

As the secondary market spread available to lenders shrinks due to competition for a dwindling supply of new loans, large nonbank lenders are seeking to defend their profits by lowering the cost of funds from the major banks. Meanwhile, commercial banks as an industry continue to withdraw from both residential mortgage lending and servicing. If you want one picture to describe why the Federal Housing Finance Agency (FHFA), Federal Housing Administration (FHA) and the Financial Stability Oversight Counsel (FSOC) are worried about nonbanks, here it is below.

Source: FFIEC

Looking at the chart above, the increase in mortgage servicing by nonbanks is dramatic and again illustrates the retreat of commercial banks from both owning and servicing 1-4 family mortgages. Progressive elements in the American political equation, many of whom have influential roles in the Biden Administration, have effectively made US consumers toxic from a risk perspective. Prudential regulators reinforce this trend of risk avoidance and the depositories have reacted accordingly.

Also, we should recall that the risk-adjusted returns on residential loans are negative, even before accounting for reputational risk. Thus, again, the depositories have made the rational decision and are avoiding high-LTV, low-FICO borrowers. Bank of America (NYSE:BAC), for example, a decade ago turned its back on wholesale and correspondent lending after acquiring Countrywide to the considerable detriment of shareholders.

Turning from the balance sheet to the income statement, the US banking industry saw a strong rebound in income in Q4 as credit provisions continued to fall and there were even some releases of reserves back into income. We discussed the outlook for Q1 2021 bank earnings in our recent comment (“Q1 2021 Update: QE Forever Will Kill US Banks”).

The basic calculus of bank earnings this year fundamentally turns on credit costs, particularly in commercial loans. Whereas a year ago we and most other analysts were bracing for a big uptick in consumer defaults, that result did not materialize. The CARES Act and other federal and state debt moratoria have pushed eventual consumer credit costs out another three to six months. The chart below shows loan loss reserves vs charge-offs through Q4 2021. Suffice to say that we expect to see further reserve releases into income in Q1 2021.

Source: FDIC

As one senior regulator told us this week, eventually the forbearance will end and then will come the reckoning. And when the banking industry is forced to again build reserves, income will be negatively impacted. But for now, realized losses (aka “charge offs”) of bad loans are running at very low levels, even with the uptick in commercial loan loss severities, suggesting several quarters of reserve releases lie ahead. The rate of reserve release will depend upon prudential regulators and auditors, who must endorse future bank loan loss projections.

Bank Credit Charts

Below are the credit charts for the $10 trillion loan portfolio of the US banking industry. We use two perspectives: First, the rate of delinquency and charge-offs is shown. Second, we look at loss given default (LGD), which is the net loss after recoveries. We use the simple form of LGD going back to Basle I because it provides a clean look at how banks are managing credit.

In those series tied to residential housing, the shortage of existing homes, and the low interest rate environment and quantitative easing (QE), have badly skewed the LGDs into negative territory. This means that in those rare instances of a default actually going through to foreclosure, the bank pays off the full amount of the loan and takes the surplus back into loan loss reserves.

Total Loans & Leases

Notice in the chart below that delinquency is rising, but charge-offs are falling, a graphic illustration of the impact of loan forbearance c/o the CARES Act and state loan payment moratoria.

Source: FDIC

Source: FDIC/WGA LLC

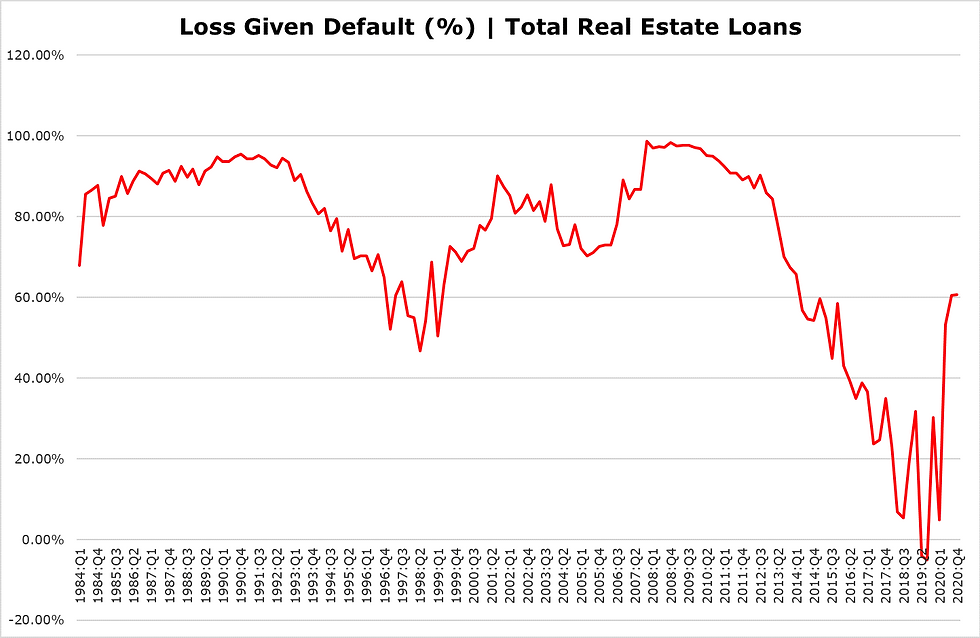

Total Real Estate Loans

The chart for total real estate loans displays the impact of the FOMC's interest rates policies as well as loan payment moratoria,

Source: FDIC

As with all bank loan types in the real estate sector, LGD for all real estate loans has been near zero or negative for several years due to QE, but more recently realized losses post-default have begun to trend higher.

Source: FDIC/WGA LLC

Construction & Development Loans

Source: FDIC

Source: FDIC/WGA LLC

Residential Construction Loans

Source: FDIC

The data series for residential construction loans is relatively new reporting item for FDIC-insured banks. Notice the huge skew downward caused by a large recovery in this relatively small portfolio.

Source: FDIC/WGA LLC

1-4 Family Loans

As with the other real estate series, the $2.5 trillion portfolio of 1-4 family loans shows rising delinquency but falling losses, again illustrating the impact of loan payment moratoria.

Source: FDIC

As discussed above, the LGD for bank-owned 1-4 family mortgages is negative, illustrating the powerful credit effect of low interest rates and the relative shortage of supply for residential housing. Simply stated, in the current economic environment, credit in bank-owned 1-4s has little or no cost for US banks.

Source: FDIC/WGA LLC

Home Equity Loans

As with 1-4 family first lien mortgages, home equity loans also display the powerful impact of rising home prices and falling interest rates, which combined have forced net default rates on HELOCs down to zero.

Source: FDIC

Source: FDIC/WGA LLC

Rebooked GNMA Loans – EBOs

Rebooked Ginnie Mae loans are delinquent loans repurchased out of pools of MBS by issuers, who then modify or restructure the "early buyout" or EBO. There was a surge of such buyout activity in Q2 and Q3 2020, in the case of banks led by Wells Fargo (NYSE:WFC). Nonbanks such as PennyMac (NYSE:PFSI) have been leading purchasers of EBOs as well.

Source: FDIC

Multifamily Loans

Source: FDIC

Source: FDIC/WGA LLC

Commercial & Industrial Loans

Unlike the loan types related to residential real estate, the series for C&I loans displays a relatively normal profile for the pricing of risk. Net charge-off rates are currently being suppressed due to loan payment moratoria. As and when loan forbearance ends, the loss rates are likely to rise sharply.

Source: FDIC

Source: FDIC/WGA LLC

Credit Card Loans

Source: FDIC

Source: FDIC/WGA LLC

Auto Loans

As with other consumer-related loan types, auto loans have shown a sharp decrease in net charge-off rates since the passage of the CARES Act. As and when these politically-mandated forbearance programs end, loss rates are likely to rise sharply.

Source: FDIC

Since the passage of The CARES Act, LGD on auto loans has been cut in half, reflecting both the legal suspension of loan collection efforts and also the increased demand for used vehicles. As and when the legal forbearance ends, we expect to see post-default loss rates return to the 60% long-term average.

Source: FDIC/WGA LLC

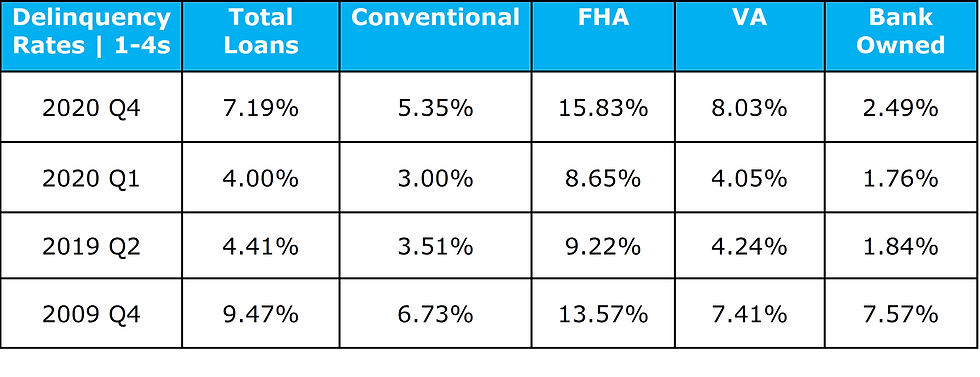

Residential Loan Delinquency

Looking at the complex of residential mortgages, overall rates of delinquency are relatively low, but the FHA loan market is an area of concern. Delinquency rates are already above 2008 levels and in some states are over 20%, suggesting that there could be significant credit expenses for lenders and the FHA in the future as loan forbearance ends.

Source: MBA/FHA/FHFA/FDIC

Industry Outlook

We anticipate significant loan loss reserve releases back into income in Q1 2021 and thereafter as banks adjust their loan loss provisions to reflect actual and expected loss rates. The enormous pile of loan loss reserves put aside in Q2 2020 is an order of magnitude too large given current and prospective loss rates.

Even as bank earnings are helped by reserve releases in the near term, we expect to see asset returns for US banks continue to fall under the oppressive weight of QE and the FOMC's low interest rate policies. Returns on earning assets for US banks are likely to fall another 5-10bp in the next four quarters.

We expect to see credit loss rates at US banks normalize as CARES Act and state-law debt payment moratoria end, but the rates of loss are likely to be well-below 2009 levels. The cure rate for forbearance loans in the US residential mortgage market is ~ 50%, for example. This suggests that bank loan loss reserve levels are far too high and that asset returns, and not credit, are the key areas of concern for bank investors in 2021.

The IRA Bank Book (ISBN 978-0-692-09756-4) is published by Whalen Global Advisors LLC and is provided for general informational purposes. By accepting this document, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The IRA Bank Book. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The IRA Bank Book are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The IRA Bank Book represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The IRA Bank Book is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The IRA Bank Book is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The IRA Bank Book. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments