Interview: James Koutoulas of Typhon Capital Management

- Apr 15, 2020

- 6 min read

Updated: Nov 8, 2021

New York | Since we are in the midst of earnings season, we thought to check in with James Koutoulas, CEO of Typhon Capital Management, a tactical futures-focused hedge fund manager located in Chicago. We met James when he led the customers of the defunct broker dealer MF Global to a full recovery of $6.7 billion in their epic fight with the firm’s former CEO and New Jersey Governor Jon Corzine. Since then he and his growing stable of portfolios managers have managed to surf the waves of global volatility, a task that affords James an always interesting perspective. The IRA: James, thanks for your time. Talk to us about your view of the markets given your broad offering of strategies, everything from metals to crypto. Koutoulas: We have 15 managers in our stable at present. Through March our best performing strategy was our Leonidas Macro Fund which is up 32%year-to-date. What I emphasize to our team is stick to your knitting. If you are a grain trader, your job is to trade grain spreads. You must be cognizant of global events and demand, especially now with COVID-19 and the way it changes the behavior of major exporters. In times of crisis, all correlations tend to trend towards 1, so focusing on the fundamental return drivers of your strategy is still the key.

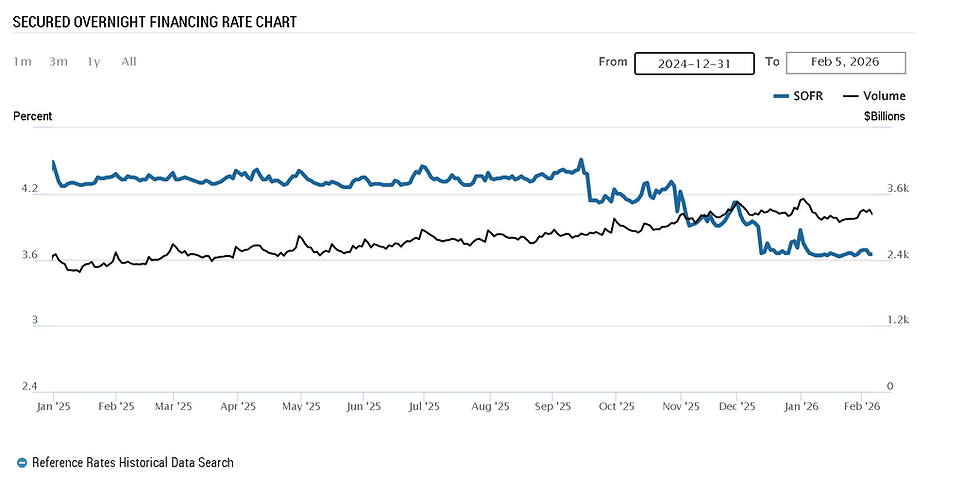

The IRA: We imagine that energy has been an active area for you this quarter. Tell us about the action in energy and oil. Koutoulas: I spend a lot of my time with the global macro team and we’ve had an incredibly active quarter like the rest of the street. The massive increase in volatility around oil, the plunge in prices down to $20 per barrel, and the very modest rally have been a challenge. There is a great deal of uncertainty due to demand destruction and big stocks of crude floating around the world. The Saudi attempt to destroy other producers by flooding the market, and the Russian response, has made this among the most active trading markets. Our energy strategy is part of the Leonidas Macro Fund, both led by George Michalopoulos who used to be Citadel’s senior most energy derivatives traders. He’s up 14.5% YTD in the energy book, but only averaging about 1% margin usage to support that outstanding energy PNL. The IRA: So, really, how do you trade a market that is so volatile and so idiosyncratic? Koutoulas: We really try to avoid taking directional bets. For Leonidas’s huge quarter, we had almost no directional bet, and instead we bought up cheap, fixed risk option structures to give us a long volatility profile. We started doing that in January once we saw the writing on the wall with COVID19. Back in October we wrote about the markets exhibiting “pre-crisis behavior” When you saw overnight borrowing rates spiking to extraordinary levels, that told you that something was disturbing these normally risk-free markets. Going from near zero to ten percent in a day told you that something systemic was going to happen. We didn’t know about COVID-19 yet, but something was already wrong in the markets’ plumbing in the fall. The IRA: A tremor in the force. Do you think the weakness in new issue volumes in corporates and ABS visible in that period was telling us the same thing? Koutoulas: It’s remarkable to me how the Federal Reserve has managed to suppress discussion of the true causes of the repo volatility. You can blame volatility on a trading desk blowing up or some other reason, but to me ten years of QE and artificial liquidity infusions, followed by periods of liquidity shortage, are the causes of our collective pain. The artificial liquidity in the market re-inflated all the asset bubbles that popped in 2008 and then took them to even greater size, so the calculus really came down to when the correction would occur. To our view and what we wrote at the time was that the market was starting to break down in October in some very basic ways and that systemic risk in the system was already high. Then COVID19 came around and was the catalyst for the selloff. The IRA: And certainly, commodities and particularly oil seems to have been impacted the most from the anticipated demand shock. Would you agree? Koutoulas: Our macro and oil manager identified COVID-19 as a major catalyst behind much of the moves in commodities very early on. But there were other signs -- if you looked. For example, consider the number of corporate CEOs that resigned in Q4 2019 and Q1 of 2020. The party was clearly over. A year and more ago, people started using the term “late cycle” and the whole orientation of the market was turning. All of the narrative was preparing people for a market turn. And we were already showing economic weakness before we got into 2020. Copper prices, the Baltic Dry Index, the repo market and the credit market. They were all flashing warning signs and a number of the more experienced managers said so – but the crowd ignored the warnings. So COVID19 materializes and it was a perfect, simple catalyst to deflate the artificial bubble. Once we knew the virus had a long incubation period and traveled through the air, there was not way to stop it – and the markets reacted. The IRA: The virus seems to mostly affect the elderly and infirm, but the economic impact is also very much hitting the most vulnerable parts of society, people who don’t own businesses and cannot seek assistance. Given that testing an isolation are clearly the best approaches to dealing with COVID19, how long is the impact likely to be felt? Both in the economy and also politically? Koutoulas: The shame is that an earlier response might have saved a lot of lives. Had we gone to a quarantine in February, for example, and stepped on the gas in terms of testing, we’d be ahead of the game now. There was no political capital, however, to push the nation to a quick response. Donald Trump was fighting the failed Democratic impeachment effort, so only when he started to recover in the polls was President Trump able to marshal the focus and resources needed to respond to COVID19. In retrospect, the trumped-up impeachment charges brought by Nancy Pelosi (D-CA) were very costly indeed. The IRA: A total waste of time. And it set the stage for the great market evacuation that has destroyed trillions in paper wealth. How do you see the outlook for the markets and the economy, especially the commodity complex? Our view on US banks, for example, is that roughly half of the households seeking a holiday on mortgage payments will eventually turn into outright defaults. Koutoulas: The impact on small business and younger workers generally is severe. Many millennials start off in trades and service businesses, which are being decimated. For people in finance, we tend to get into this isolated bubble. The contractors and waiters and other workers are having trouble getting help and are literally running out of cash. Your average middle-class person who was just barely getting by in the gig economy is getting crushed. All of the infrastructure designed to help a few people cope with economic stress is now being overwhelmed. There will be a lot of collateral damage even if the lockdown ends soon. There will be massive economic destruction from COVID19. The IRA: So what do you tell your investors? Koutoulas: Maybe it's our roots in commodities trading, but we have been yelling about market technicals since 2018. We explicitly told clients in our writings and even started a conference business conference to tell investors that we’ve had a ten-year bull rally floated on Fed credit. Be proactive! Take some money off the table. That was the message. We continue to emphasize trading strategies that are first and foremost liquid. We like relative value relationships where we are unlevered. Our bet was driven mostly by a macro view of the economy, in oil for example. We made money not because we bet one way on falling oil prices, but because we worked the spread relationships combined with some very cheap VIX options. And we made 14.5%. These are the types of strategies that let you trade volatile markets but protect you at the same time. The IRA: Thanks James. Be well.

.png)

Comments