Does Kathy Hochul Have a New York Community Bank Endgame?

- Mar 6, 2024

- 7 min read

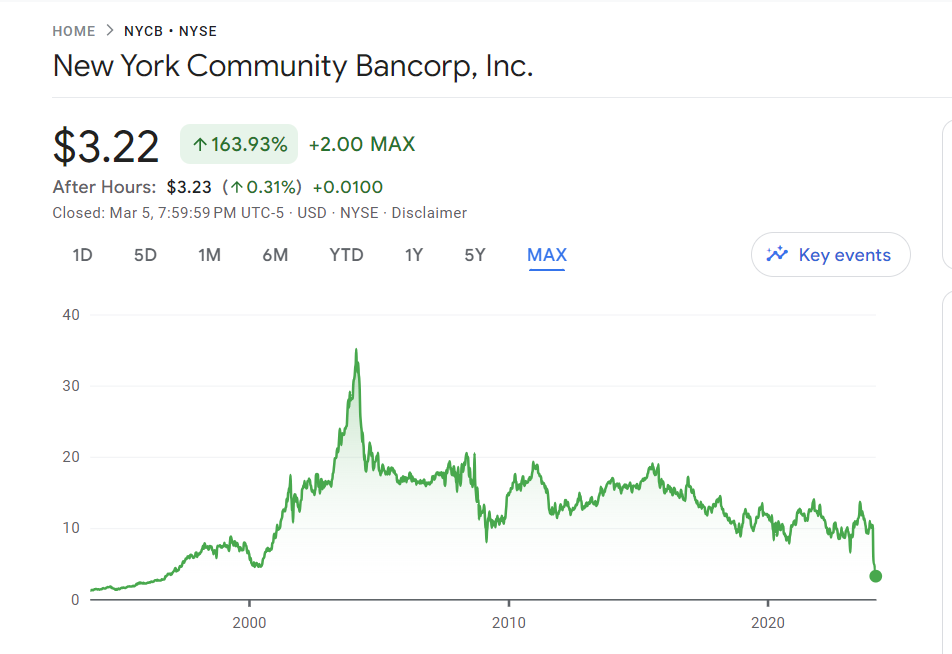

March 6, 2024 | Updated |A number of readers of The Institutional Risk Analyst have asked about the situation with New York Community Bank (NYCB). The short answer is that we think that the bank may be sold, one way or another. The profitable Flagstar residential servicing business could be offered for sale in order to make a downpayment for the cleanup of the NYCB legacy multifamily portfolio. But in the wake of credit downgrades, NYCB itself may need to be acquired by another bank.

Source: Google Finance

KBW said in a research note that NYCB could tap into its $78 billion in unpaid balances of mortgage-servicing rights to raise capital through a potential sale. The portfolio has a carrying value of $1.1 billion, analysts said. That is a mere downpayment, however, on a larger mess emanating from the bank's impaired multifamily assets.

Without an investment grade credit rating, banks cannot hold escrow balances for conventional or government loans. We cannot see how NYCB keeps the billions in conventional and government escrow deposits long-term. The whole Flagstar servicing platform and more than $300 billion in residential loan servicing, mostly for third parties like nonbank mortgage issuers, needs a new home.

Obviously the shareholders of Flagstar are coming to rue the decision to join forces with NYCB, an under-managed community bank with a portfolio of performing but ultimately unsalable multifamily assets. Thanks to the New York State legislature’s 2019 rent control law, which was supported by Governor Kathy Hochul, all banks in New York City that hold rent stabilized assets on the books are now capital impaired. Several of these banks in New York City may fail as a result of Albany's actions.

So who might acquire NYCB? First, we take JPMorgan (JPM) and Wells Fargo (WFC) off the table. The former is already the largest residential mortgage servicer in the US and the latter is exiting the residential mortgage business with finality. The departure of Wells from residential mortgages is bad news for consumers and cause for glee among progressive cadres in the Biden Administration. In any event, neither bank wants any part of the Ginnie Mae sub-servicing book inside Flagstar.

Next is Citigroup (C), an intriguing possibility for a bank that badly needs new ideas and revenue streams. Citi has been in and out of residential mortgages for the past 50 years. In the 1980s, Citi introduced the first no-doc mortgage in the US market.

Since subprime consumer credit is a big part of Citi’s business, why not add a good sized residential mortgage business and get back into the housing finance game? There are few other industry segments that have enough size to matter to Citi. Flagstar is the number two warehouse lender after JPM. Overnight, Citi becomes the top bank servicer in the Ginnie Mae market and a significant issuer of MBS.

After Citi the obvious candidate for NYCB is U.S. Bancorp (USB), which is now the second largest residential bank loan producer after Chase. Although USB is still digesting the acquisition of Union Bank of California, they are a player in residential servicing and loan administration. USB could easily acquire the NYCB mortgage platform and billions in escrow deposits.

The idea of NYCB losing stable escrow deposits argues against the sale of the Flagstar mortgage platform and in favor of selling or recapitalizing the whole bank. But is this possible short of an FDIC intervention? Again, the actions taken by Albany in 2019 make NYCB and other New York banks unsalable short of an FDIC takeover.

If you are an investor looking at NYCB, the big question is the 40% of total loans and leases in multifamily assets. If NYCB were to either sell or risk-share a substantial portion of the rent stabilized multifamily assets, then the prospects for the business improve significantly. But given the disclosures about weak controls over loan underwriting, investors are going to be very cautious about making any assumptions on valuation. And risk-sharing is not yet broadly relevant for commercial assets.

Looking at the volume of risk-sharing deals done by banks so far, virtually all of the transactions are for consumer facing assets. Banco Santander (SAN) leads the pack on risk sharing auto and consumer loans. Commercial loans are far more difficult. Western Alliance (WAL) and Texas Capital Bank (TCBI) have done risk sharing deals in prime RMBS and warehouse loans, but commercial mortgages will likely be handled as customized, bespoke arrangements done on single loans. Selling the loans outright to hard money investors may be easier.

NYCB might want to consider creating a separate “bad bank” containing rent stabilized assets from the legacy NYCB to put pressure on Governor Hochul and the New York legislature to come and clean up their mess. Indeed, FDIC Chairman Martin Gruenberg ought to lead that discussion with Governor Hochul. His agency – and all the FDIC insured banks he represents – now hold the bag on billions in eventual losses on rent-stabilized Signature Bank commercial mortgage loans as well as loans held by other banks. The intemperate actions of the State of New York caused these losses.

We expect to see a number of creative structures being rolled out to address the impairment of multifamily commercial mortgages on the books of US banks. Risk-sharing is useful and can actually reduce the risk weighted assets of a bank and improve capital ratios, but at a cost to the bank in terms of income. Other techniques involve selling the low-coupon mortgage and replacing it with risk-free collateral that generates a similar cash flow, but frees up regulatory capital for other purposes.

Despite the promise of risk-sharing transactions, at the end of the day raising new capital and managing the delinquency may be a better approach. In the case of NYCB, raising new equity seems not feasible. Indeed, any prospective buyer may demand some form of loss sharing from the FDIC on the multifamily book. If, for example, we assume a conservative 20% haircut on rent-stabilized buildings in NYC, many of the smaller institutions are insolvent.

That said, we would not be surprised to see an arranged marriage involving NYCB and a larger player that wants a bigger role in aggregating, selling and servicing residential mortgages. Even the likes of Goldman Sachs (GS), which has a significant presence in lending on residential warehouse loans and mortgage servicing rights, might find NYCB a compelling opportunity -- given the proper incentives from FDIC, of course.

Bloomberg columnist Max Abelson wrote an epitaph of sorts for NYCB this week:

"How NYCB got here is a tale of percolating financial risks, changing rules and shifting regulators. New rent restrictions became law in 2019, but instead of acknowledging a hit to its loan book, the bank got bigger. Back-to-back acquisitions, first Flagstar and then parts of Signature Bank, almost doubled the firm's size and set it on a collision course with new rules for banks holding more than $100 billion of assets."

We still own NYCB, but we strongly recommend that our readers stand clear until management gives shareholders a very specific roadmap to recovery. The economics of the bank's multifamily book are gnarly at best. Does the FDIC want to resolve another $100 plus billion asset regional bank? Hell no. Because the mess flows downhill, it may be time for creativity on the part of the FDIC and the State of New York.

FDIC Chairman Gruenberg ought to tell Governor Hochul and New York State to take over the rent stabilizeded loans from Signature, NYCB and other lenders or face an old fashioned FDIC liquidation as and when any banks fail. The number of public housing units in New York City will soar, placing enormous pressure on the city's finances. If the multifamily building cannot be financed by a bank, then the City of New York likely will end up as the owner.

Imagine if FDIC went "by the book" and next week sold all of the rent stabilized Signature Bank multifamily assets for whatever hard money bid is available. New York would face a political crisis. Governor Hochul and progressives in Albany caused this mess, which now threatens the solvency of a number of New York banks. The State of New York should take ownership of its fine work and repeal the 2019 rent control legislation.

But of course we already know the endgame put in place by the FDIC under Chairman Gruenberg. The banking industry via the FDIC will absorb the losses on rent-stabilized multifamily assets in New York City. The FDIC may retain the majority interests in the Signature Bank assets indefinitely. And as it states in the RFP from the FDIC offering the Signature Bank assets for sale, the rent-stabilized apartments must remain so forever, with no possibility of ever becoming market rate.

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy, or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

The NYS rent restriction law of 2019 would have been known to both the regulators who approved NYCB acquisitions AND to IRA which regularly promoted NYCB as a safe, well run, bank, correct?

None of the scenarios outlined above seem likely. On the other hand, what are the odds that the owners of those NYC M/F properties walk away? As of now, not very high, IMO.

And. the FDIC isn't going to inject itself into NYS politics. They'll do the same as always ... kick the can down the road.