top of page

Should the FOMC End Fed Funds Targeting? Issue CMOs?

As Chairman Powell said in the latest FOMC presser, the SOMA reinvestment plan is intended to get their duration down to that of the Treasury debt outstanding by allowing long duration MBS to be replaced by short-duration T-bills. Could the Fed have continued to shrink the SOMA further as Bowman and others have urged?

-

Nov 5, 20259 min read

Silver Surges? Waller Wants Lower Reserves & Tighter Policy

The leading candidate to be the next Fed Chairman believes the balance sheet could safely shrink to around $5.8 trillion, with bank reserves potentially decreasing to $2.7 trillion. Waller argues that a shift towards more short-term Treasury bills would make the balance sheet safer and more flexible, and he is absolutely right.

-

Jul 14, 20255 min read

QT + Lower Federal Outlays = ?

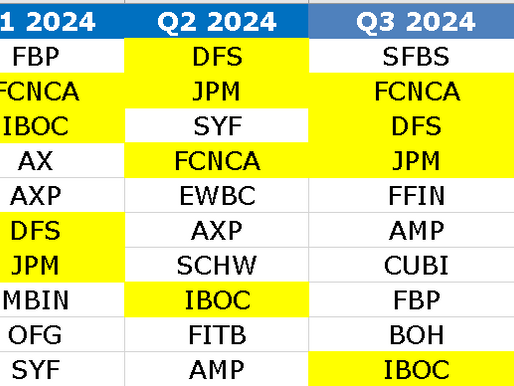

Banks continue to show a strong preference for late vintage loans over securities, a fact which may cause loan yields to continue falling

-

Feb 11, 20255 min read

Fed Duration Trap Threatens Banks, SOMA

It’s time for the Fed to get smart on duration risk before circumstances create another money market crisis.

-

Nov 1, 20248 min read

Bank Reserves & Treasury Auctions

As the public debt of the US grows, after all, the implicit claim of the Treasury on all private US assets also grows.

-

Jan 8, 20248 min read

bottom of page

.png)