top of page

Does Private Credit Hurt Bank Stocks?

But more to the point, the comingled worlds of private equity and credit may be the biggest scandal to hit Wall Street in a century. Most bank loans to PE sponsors "secured" by private company assets are actually non-recourse, so there is no recovery for the bank in the event of default. We think these factors are just some of the reasons that exposures to private equity and credit may be the most risky part of bank loan portfolios.

-

Jan 157 min read

The Wonderful Asymmetry of Gold & Silver Investments

Silver has always been the common man’s metal, but the unique combination of industrial necessity and monetary appeal has helped to resolve its historical "identity crisis," making it both an industrial input and an investment asset.

-

Dec 21, 20255 min read

Interview: Robert Brusca on the Federal Open Market Committee

Powell won’t hit the two percent target, but he won’t change the target either.

-

Jun 10, 20249 min read

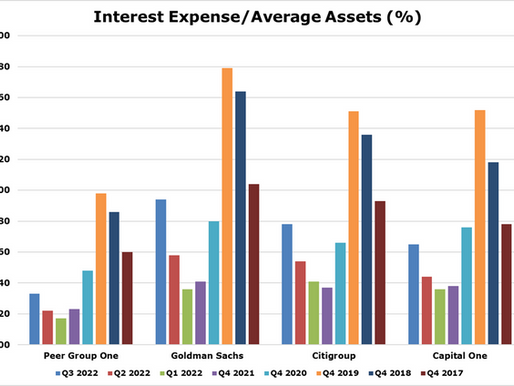

Goldman Sachs + Bank of New York Mellon = ?

The risk-adjusted return on capital for BK is negative and probably lower than Goldman, the highest risk large US bank

-

Feb 6, 20237 min read

QE, Risk Premia and Option Adjusted Spreads

There a brisk debate ongoing in the fixed income markets over how much the Federal Open Market Committee will raise interest rates and when

-

Mar 15, 20225 min read

bottom of page

.png)