top of page

RKT Sinks, UWMC Wobbles, RITM Treads Water & Goldman Doubles Down

GS is a securities dealer first and foremost and has no comparative advantage as a bank.

-

Mar 2, 20236 min read

QT & Powell's Liquidity Trap

The Federal Open Market Committee has arguably lost control of monetary policy and has placed America's banks in grave risk.

-

Feb 27, 20236 min read

The Return of Credit Risk

Fact is, Dr. Brainard has primary culpability in the growing economic pain being felt around the country.

-

Feb 23, 20237 min read

Is Stripe Worth $55 Billion? Really?

CEO Patrick Collison is guiding investors and the media to a $200 million profit in 2023. Selective disclosure??

-

Feb 21, 20236 min read

Will We See Double-Digit Residential Mortgage Rates -- Again?

As the FOMC moves short-term rates towards 6%, we expect to take another run at double-digit rates for prime residential mortgage loans.

-

Feb 16, 20235 min read

Ginnie Mae - Credit Suisse = ? A Biden MSR Tax? Does BKI + ICE = < 2?

Our view is that the BKI purchase is a horrible deal for ICE shareholders, a value killer of epic proportions

-

Feb 13, 20238 min read

Mortgage Wrap; PennyMac Financial, Rithm Capital & MSRs

We suspect that the IMBs will be sellers of conventional assets to defend their Ginnie Mae MSRs. Banks may be buyers of conventional assets

-

Feb 9, 20237 min read

Goldman Sachs + Bank of New York Mellon = ?

The risk-adjusted return on capital for BK is negative and probably lower than Goldman, the highest risk large US bank

-

Feb 6, 20237 min read

Two Inflation Narratives; Credit Suisse & Ginnie Mae MSRs

The big take away from Q4 2022 earnings is that credit expenses are headed higher and at a brisk pace

-

Feb 3, 20239 min read

Why the FT is Wrong About Ally Financial

Ally is still more finance company than bank and really has no core deposit base worthy of the name.

-

Jan 30, 20237 min read

Silvergate, Reverse RPs and the “Theology of Prosperity”

Crypto, of course, is not an asset as much as a bad idea that was given life by Quantitative Easing

-

Jan 25, 20238 min read

Update: Bank of America

We hear in the channel that regulators are making their views of future loss probabilities very clear in guidance to the top banks

-

Jan 23, 20236 min read

Interview: Mike Patterson, Freedom Mortgage

In this issue of The Institutional Risk Analyst, we speak to Mike Patterson, COO of Freedom Mortgage.

-

Jan 19, 20239 min read

Goldman Drops Restatement; Jamie Dimon Drops the Ball on "Frank"

The Fed’s de facto embrace of inflation encourages misallocation of economic resources on a grand scale....

-

Jan 16, 20237 min read

Update: JPMorganChase & Wells Fargo

But nothing lasts forever in mortgage land or in financials. Stay tuned and pay attention to LT rates and spreads...

-

Jan 13, 20236 min read

Crypto Collateral Damage Mounts

In other words, those residual claims on crypto issuers that have been trading at pennies on the dollar may have no value whatsoever.

-

Jan 9, 20237 min read

Update: Truist, Charles Schwab, U.S. Bancorp & PNC Financial

The largest banks continue to serve as a haven for refugees from crypto fraud schemes and the fintech swoon, but are not cheap

-

Jan 4, 20237 min read

Predictions for the New Year 2023

Will Fannie Mae and Freddie Mac require another federal rescue in 2023 or beyond?

-

Dec 30, 20229 min read

GNMA, FNMA Seize Assets from Reverse Mortgage Funding Estate

The US government now owns the largest reverse lender in the country.

-

Dec 22, 20226 min read

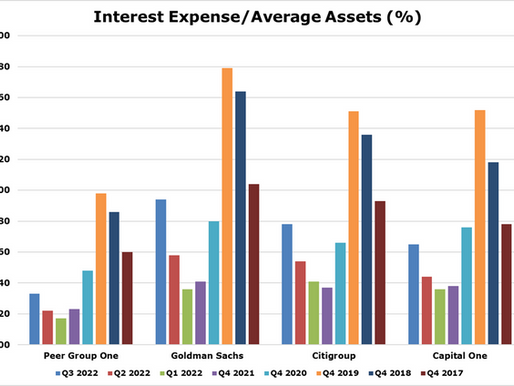

Outliers: CapitalOne, Goldman Sachs & Citigroup

Like most nonbanks (and Goldman Sachs is predominantly a nonbank), volumes are falling and funding costs are rising.

-

Dec 20, 20225 min read

bottom of page

.png)