Fed Policies Hurt Bank Earnings

- Jun 2, 2019

- 3 min read

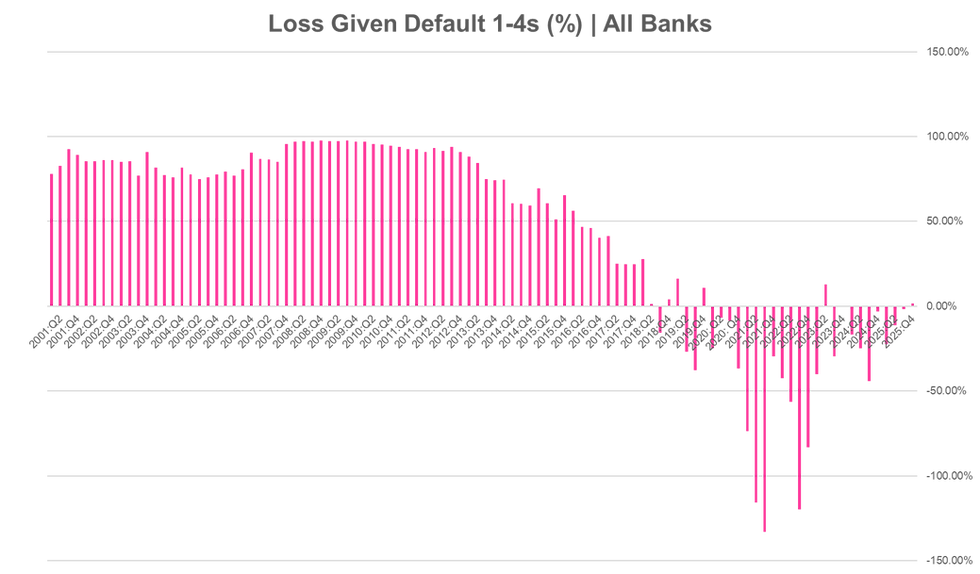

New York | A year ago in The Institutional Risk Analyst, we predicted that net interest income for the US banking industry would flatten out and decline around Q1 2019. Sure enough, that is precisely what has happened. We wrote in The IRA Bank Book for Q1 2019:

"The cost of funds for US banks continues to grow at four times the rate of interest income, suggesting that the net-interest margin earned by banks may start to decline in 2019. Rising funding costs are being felt the most by smaller banks, driving the rate of change in interest expense over 70% year-over year 2017-2018. Quarterly funding costs for all US banks should be close to $60 billion by the end of 2019 vs $37 billion in Q4 2018, a mere 62% rate of change as shown in the chart below."

Source: FDIC

As short-term deposit costs normalize, the margin on loans and other assets that banks earn over funding is being squeezed. We notice that the 10-year Treasury note closed at a yield of 2.13% on Friday, more than a point below the November 2018 peak yield of 3.25%. So long as the Federal Open Market Committee persists in artificially propping up short-term interest rates, bank earnings will remain under pressure and many non-bank financial firms will be in jeopardy of outright failure.

Markets are slowly coming to understand that the use of negative interest rates as a policy tool has more downside than benefit, especially when it comes to asset returns. We’ll be publishing a conversation with our friend Jim Rickards about his timely new book, “Aftermath: Seven Secrets of Wealth Preservation in the Coming Chaos.” In his latest work, Rickards notes:

“It is understandable that the Fed wishes to resume what it regards as normal monetary policy after the better part of a decade of abnormal ease. The difficulty is that the Fed has painted itself into a corner from which there is no easy exit… Internally the Fed has congratulated itself on their fine-tuning and market finesse. They shouldn’t have. All the Fed proved in recent years was that they really couldn’t exit extraordinary policy intervention without disruption. The Fed has been storing up trouble for another day. That day is here.”

It is important to note that Rickards joins a long list of economists and market observers who criticize the Fed’s reckless use of radical monetary policies to control markets. In an interview with The Financial Times, Dr. Judy Shelton calls on the Fed to “think about whether they are doing more harm than good”. If appointed to the Federal Reserve Board, the FT reports, she would be “asking tough questions” about its most basic mission.

Maybe Dr. Shelton could also ask when Congress gave the Fed authority to nationalize the short-term money markets. “How can a dozen, slightly less than a dozen, people meeting eight times a year, decide what the cost of capital should be versus some kind of organically, market supply determined rate? The Fed is not omniscient. They don’t know what the right rate should be. How could anyone?” Ms Shelton argues.

With the Fed holding up short-term interest rates and long-term yields falling under pressure from continued asset purchases by global central banks, the outlook for banks and other leveraged investors is decidedly negative. We’ll be discussing the growing threat to US banks and other interest rate dependent investors posed by the Fed’s unsafe and unsound monetary policies in the next edition of The IRA Bank Book for Q2 2019.

.png)

Comments