top of page

FSOC Frets About Nonbank Risk; Goldman Sachs Stepping Back?

GS has the weakest position in terms of funding of the top-ten banks and no real narrative for the business post-Marcus.

-

Sep 21, 20236 min read

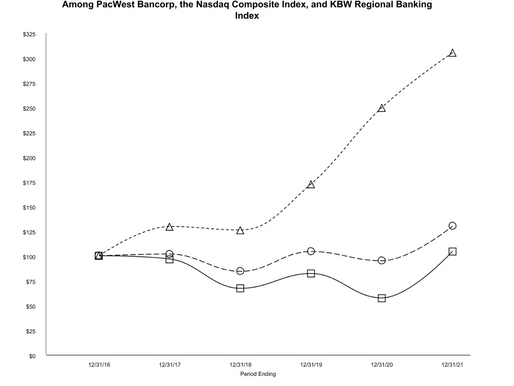

Does PacWest + Banc of California + Warburg Pincus = Value?

The Q2 2023 disclosure for PACW suggests an institution that is bleeding cash and operating in extremis...

-

Sep 18, 20237 min read

Bank Industry Review & Survey Q3 2023

The US banking industry has seen now two consecutive down quarters for net income caused by the Fed’s massive open market operations

-

Sep 11, 20233 min read

Markets Affirm the Unbearable Lightness of Fintech

When you are in a big crowd, nothing else matters.

-

Sep 7, 20235 min read

Consumer Credit Collapsing? Not Yet...

Sadly for the bears in the audience, nothing would make the banks happier than if consumers would use more credit....

-

Sep 5, 20236 min read

Winter is Coming in Bank Credit

If a bank has 6% debt to assets, what is the equity of the parent BHC worth?

-

Sep 1, 20236 min read

Jackson Hole and the Volatility of Credit

Central bankers cannot quantify any of the key benchmarks of current monetary policy beyond metaphors about stars and clouds

-

Aug 27, 20237 min read

Update: Goldman Sachs + Citigroup; Interest Rates Higher Longer?

We continue to believe that combining Citi and GS may make sense in terms of consolidating two capital markets businesses

-

Aug 23, 20236 min read

China's Debt Crisis Accelerates

Our view is that China has been caught in a debt deflation for the past five years.

-

Aug 22, 20238 min read

Reverse Mortgage Bankruptcy Festers; IRA Housing Outlook

The Biden Administration has no real strategy for addressing the growing stress in the market for government insured mortgages

-

Aug 14, 202310 min read

Update: Western Alliance Bancorp

With industry losses on every loan closed well north of 200 bp, you might ask yourself why WAL would still be buying conventional loans.

-

Aug 9, 20235 min read

Biden Administration Staggers Toward a Debt Default

Whether we have Donald Trump or Joe Biden in the White House next Christmas, the US seems to be on a trajectory to a financial crisis...

-

Aug 7, 20236 min read

RITM Goes Multi Asset; TCBI Shrinks Assets, Grows Returns

TCBI needs to keep efficiency in the 50s if they want to survive the coming drought in mortgage lending.

-

Aug 4, 20236 min read

Fitch Downgrades US to AA+; Fintech Stocks Soar on Powell Inflation

S&P was the first to call out the growing lack of fiscal discipline in Washington, downgrading Uncle Sam in 2011

-

Aug 2, 20235 min read

Washington Trip Notes; Mr. Cooper & PennyMac Financial

The last Treasury Secretary that tried to extend the maturities of US government debt was Jack Lew (2013-2017). Yellen missed an opportunity

-

Jul 28, 20235 min read

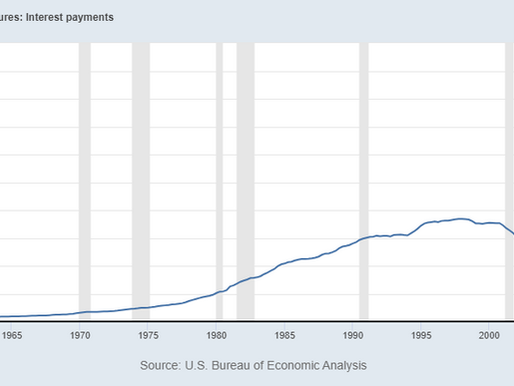

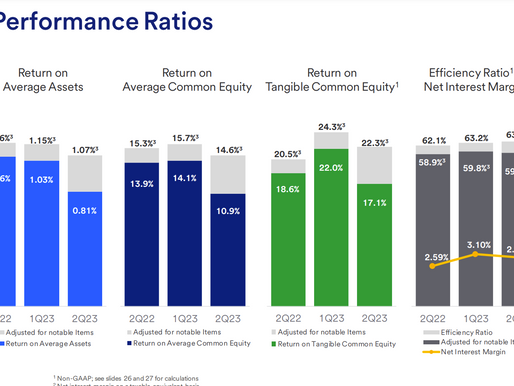

Losses Mount Due to FOMC Policy "Tax"

Inflation is called a “hidden tax,” but lately the tax is not even barely concealed.

-

Jul 25, 20235 min read

Why is JPMorgan So Big? Double Leverage

So when we ask why large banks are so big, the answer is that the Federal Reserve Board allows large BHCs to use more leverage

-

Jul 24, 20237 min read

Update: U.S. Bancorp & Goldman Sachs

We expect to see USB trading at a discount to JPM and Peer Group 1 until the bank improves its operating leverage to pre-COVID levels.

-

Jul 20, 20235 min read

What Does Washington Federal Say About Bank Earnings?

We all dodged a bullet in Q2 2023 because the repricing of assets and deposits slowed from the crazy levels seen at the end of March.

-

Jul 16, 20236 min read

Bank Earnings: JPM, WFC & Citi

JPM has an impressive lead in earnings and growth over WFC and C, neither one of which is positioned to catch up with Jamie Dimon in 2023.

-

Jul 15, 20235 min read

bottom of page

.png)