The IRA Bank Book Q1 2020

- Mar 4, 2020

- 1 min read

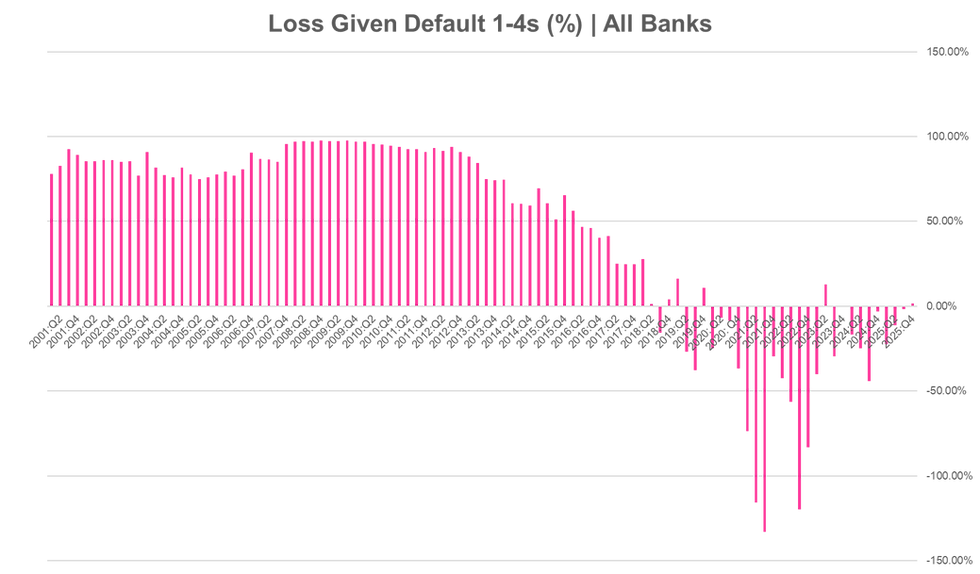

New York | Is the Federal Reserve Board killing America’s banks, pension funds and anybody else that saves with low interest rates? The answer we provide in the latest issue of The IRA Bank Book Q1 2020 is a resounding yes! Points:

* Bank interest expenses fell in Q4 as lower market interest rates and ample liquidity provided by the Fed ended the steady increase in bank funding costs since 2016. The drop in yields, however, hurt asset returns as well. Earnings are down several quarters in a row. As bank earnings fell in Q4, revenue decreased faster than funding costs.

* Despite increasing credit provisions at most banks, overall credit continues to be a distant worry. Banks are preparing for another very strong year in residential mortgage lending, a notable bright spot in terms of volume growth.

* In particular, Q4 2019 actually saw sales of mortgage notes into RMBS with servicing retained rise for the first time in almost a decade, again signaling a renewed interest in correspondent lending on the part of several large mortgage banks including JPMorganChase (NYSEJPM), Quicken Loans, Freedom Mortgage, Amerihome, a unit of Athene (NYSE:ATH) and Mr. Cooper (NYSE:COOP).

Copies of The IRA Bank Book Q1 2020 may be purchased at The IRA online store. To say thank you to readers of The Institutional Risk Analyst, copies of The IRA Bank Book Q1 2020 are on sale, 50% off through COB Friday, March 6, 2020. Just how is the @federalreserve killing America's banks? Read and learn about the true cost of Financial Repression.

Source: FDIC/Whalen Global Advisors LLC

.png)

Comments