Bank Earnings Armageddon

- Apr 15, 2020

- 3 min read

Updated: May 25, 2020

New York | This week, The Institutional Risk Analyst releases our Q1 2020 bank earnings report, which is for sale in our online store. In our latest credit comment, we feature net loss rate and earnings estimates for JPMorgan (NYSE:JPM), U.S. Bancorp (NYSE:USB), Bank of America (NYSE:BAC) and Goldman Sachs (NYSE:GS) through Q2 2020.

Suffice to say that our view of Q1 2020 bank earnings is pretty grim, but the real fun won’t start until the Q2 2020 earnings are released in about 90 days. The key variable in the credit analysis for both banks and bond investors: unemployment. In March, unemployment reached 4.5% nationally. Estimates for April vary but are all in double digits. We write: “We expect that commercial banks too will take losses on default events involving commercial real estate. Imagine, for example, the wreckage that will result from the impending default of WeWork and other leveraged investors in commercial and high end residential real estate in major cities like New York, Los Angeles and Miami."

Distressed credit investors are already assembling funds to take advantage of what may be the largest liquidation of commercial properties in a century. Rather than 2008, however, the operative model for the COVID19 crisis may be closer to the deflationary years of the mid-1930s. The chart below shows unemployment through March from the Bureau of Labor Statistics and the consensus estimate for April unemployment.

Source: BLS, Survey

Despite the grim unemployment numbers and related loan loss estimates for US banks, it is important to remember that the US banking industry is quite liquid and well-capitalized. While there are a lot of dire predictions about the economy and employment, remember that in Q4 2019, US banks had almost $150 billion in net income, dividends and cash used for share repurchases available potentially to absorb losses. This substantial cash flow is now about to absorb the full weight of the COVID19 virus disruption.

In our latest IRA Bank Earnings analysis, we assume that US bank loan loss provisions double in Q1 and then double again in Q2 2020, taking American banks back to 2009 levels of loss reserve build. Yes, the numbers for credit losses due to COVID19 are large and earnings will be ugly for the rest of the year, but in our judgement, the task is more than manageable by the US banking system.

Because US banks are stable and healthy, these institutions will be more than able to weather the huge storm of credit losses to come. In addition to $45 billion per quarter in cash earnings, the industry has $35-40 billion in share repurchases and $50 billion or so in dividends each quarter. Just by suspending share repurchases, the largest banks will retain over $100 billion annually in additional equity capital, as shown in the table below.

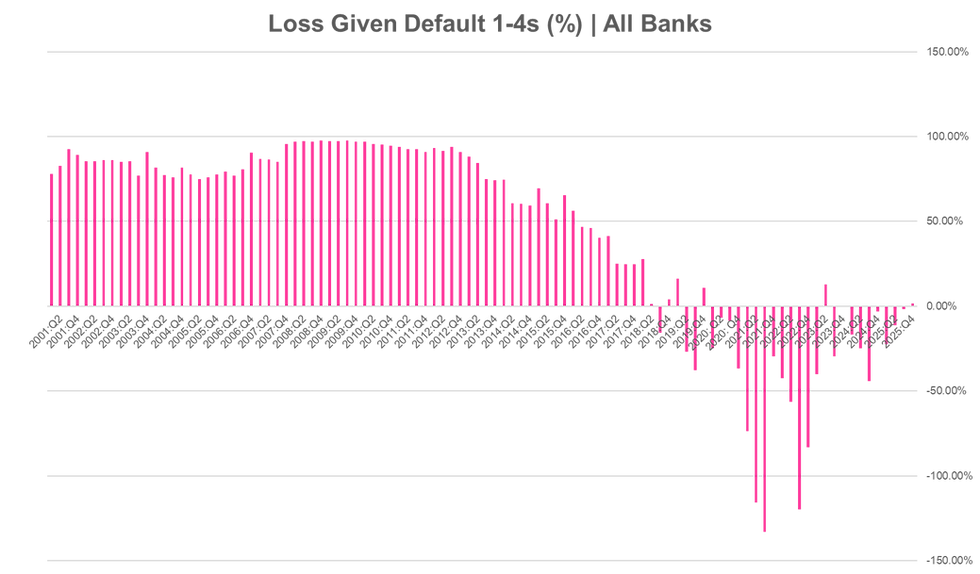

Source: Federal Reserve Form Y-9C While the banks may be islands of liquidity, though, the bond market and particularly “fringe” products such as non-QM residential mortgages and non-bank business loans and the like are going through the meat grinder. The Fed has agreed to buy limited amounts of AAA and recently investment grade paper, but there are piles of leverage loans and real estate paper that is currently looking for a bid. If we get to 5% loss rates on 1-4 family loans owned by US banks – roughly 2x the levels of 2008 – we should count ourselves lucky. Anything close to double digit loss on $2.5 trillion in residential mortgage loans owned by banks is a problem for everyone.

Why? Because if bank default rates on 1-4s go to 5%, then loss rates on the other $8 trillion in agency and government loans will be higher. The GSEs, Fannie Mae and Freddie Mac, will be swamped by loan repurchase demands and will require additional capital funds from the US Treasury. And, meanwhile, the carnage in commercial loans, CLOs and all other manner of ineligible securities will be equally bad but also will provide a sizable opportunity for the vultures. All that said, between Fed Chairman Jerome Powell’s commitment to do “whatever it takes" to liquefy the system and Dr. Fauci’s determination that the rate of infection from COVID19 may have crested, the index of FRED Spreads created by our friend Fred Feldkamp dropped 280 bps last week (a little more than 10% of its total rise during the crisis).

As we all know, falling credit spreads are good. Some people are even talking about getting “AAA” CLOs restarted by June. We’ll see. Until you see HY spreads inside of 500 bps over the curve, not much is likely to happen in sub-investment grade debt. Be well.

.png)

Comments